The increasing inflation hurts the majority of consumers around the world.

The rate of increase in price is called inflation. Sometimes, inflation is written using the Greek symbol, pi, Π.

What is inflation? What creates inflation? How does inflation affect us?

The best way to understand inflation is to relate it to your experience.

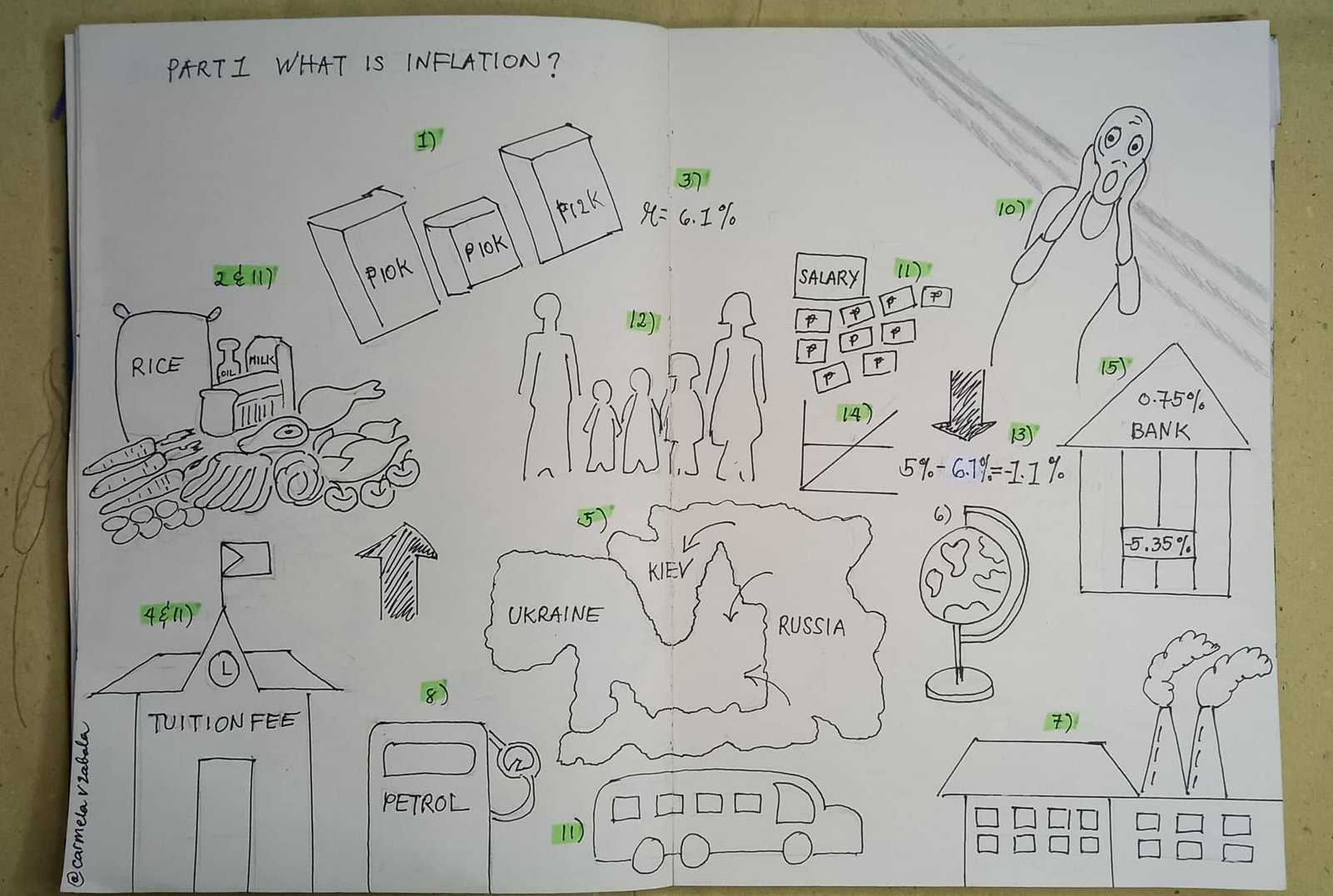

1 & 2) Your usual budget for food and other basic items buys less now than before.

You need more money to be able to buy the same basket of items than before.

High prices erode the purchasing power of your peso.

So how much is the rate of increase in prices of basic items?

3) It’s 6.1 per cent in June 2022 as reported by BSP.

Inflation can be broadly and narrowly calculated for certain goods and services. The broad calculation of inflation can be on the basic items commonly consumed like food, transport and fuel.

4) For narrow calculation, it can be, for example, the tuition fee! The tuition fee is constantly increasing in the Philippines! It is substantially higher than 6.1 per cent whether we are in an economic crisis or not.

Why inflation has gone up to 6.1 per cent?

5, 6 & 7) The Russia and Ukraine war created pressures on the supply side of the economy raising fuel prices which were transmitted from country to country by trade.

8 & 9) The high oil prices raised production costs and passed over to consumers at the pump, in our gas, electricity bills, transport, food and other goods and services.

How does inflation affect consumers?

10) The 6.1 per cent can be hard to understand logically because generally rising prices and budgeting during this high inflationary period are stressful situations.

Filipino consumers do not care if it's 6.1 per cent or 4 per cent.

11) What people care about is, that they need more money to be able to sustain their needs e.g. put food on the table, send their kids to school, pay their utility bills and live decently and they expect relief from the government to control the rising prices and they hope that employers raise their pay.

Because basic items have gone up!

Rice will continue to go up before it will go down to P20 pesos/kg [as the President promised during the presidential campaign].

Transport has a huge share in the inflation as gasoline and diesel continue to go up.

12) Did you know that the 6.1 per cent inflation has a different impact on everyone?

Well, personal finance is very personal indeed!

A single person with no dependents or a household with a thriving business or multiple incomes might be able to weather the rising prices but not a single-income household with growing children in school plus they might have caring responsibilities to their elderly parents, that either take the public transport or drive a car.

Most likely these families will feel the full weight of rising prices if the bulk of their salary goes to food, fuel, and tuition fee.

They need extra income.

13) Let’s say you receive a salary increase of 5 per cent, good for you!

Although nominally you receive a salary increase of 5 per cent, a 6.1 per cent inflation will just eat up your 5 per cent increase and chew up an additional 1.1 per cent off your salary.

In effect, your salary increase will just replace some of the loss in the real value of your salary.

Inflation hurts especially the low-income group and if you did not receive a raise prior to the Russian + Ukraine War or even before the pandemic.

14) Besides, salaries and wages are sticky. This is a basic economic principle that says employers do not respond as quickly to the changes in the economy. We are going to discuss this more in Part 2.

How about your savings in the bank?

15) The average savings rate is 0.75 per cent.

If you’ve been keeping your funds for long-term goals like retirement in the bank. Do the maths, please!

0.75 per cent less 6.1 per cent equals negative - 5.35 per cent!

That is how much less you can buy when you take your money out after a year!

You are losing the retirement savings that you placed in the bank to inflation.

We are going to discuss this more in Part 3, how to hit back at inflation.

If you have questions, please contact us at service@selfmattersph.com.

If you have family and friends that need to hear this, they will appreciate you if you can forward this post to them.

Or bookmark this article for your future reference.

Lastly, have you got a topic that you want us to discuss? let us know.

See you in Part 2.

Photo credit Leonie Wise | Unsplash