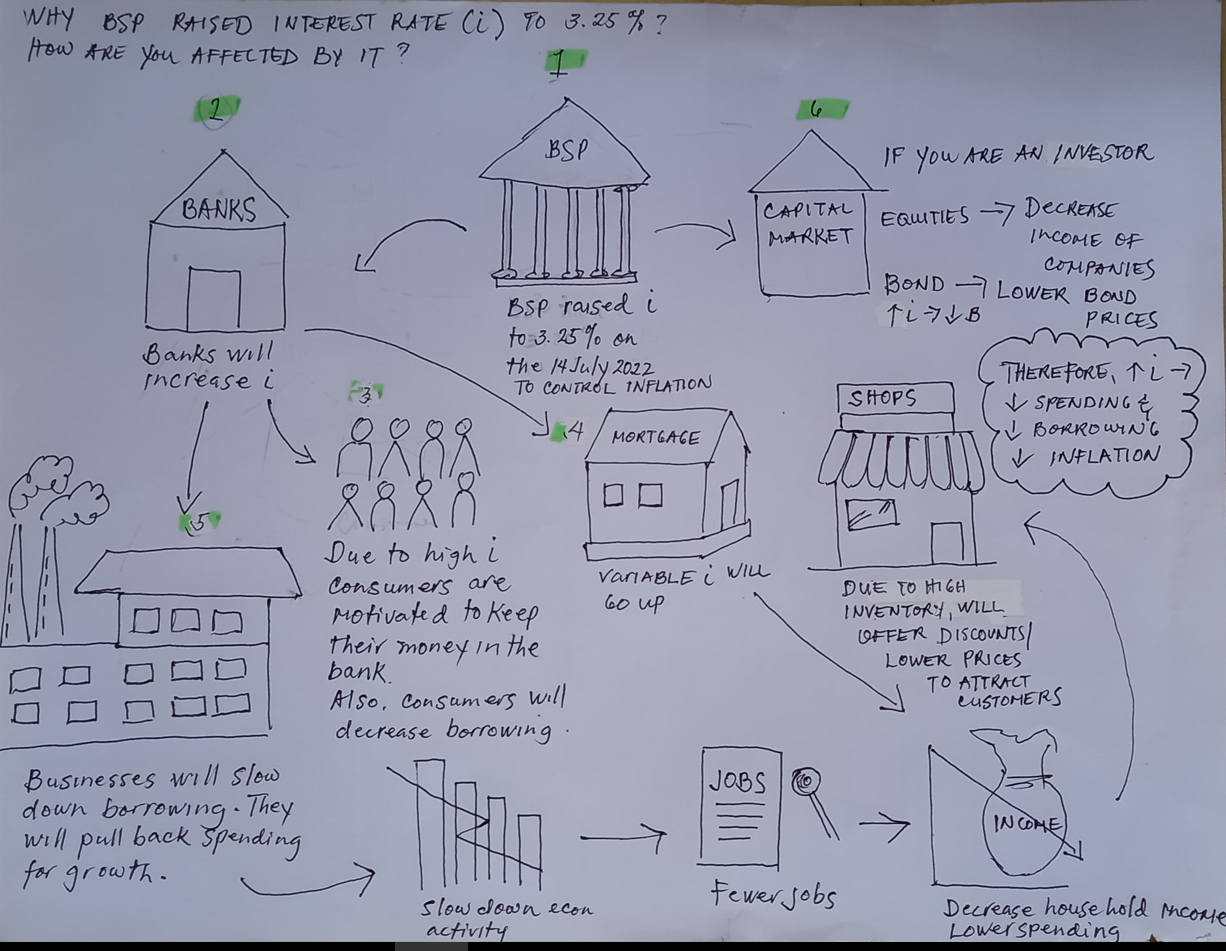

One of the ways to tame inflation is to raise interest rates.

1) BSP raised it to 3.25% [from 2.5%] on the 14th of July 2022 to control the rising inflation of 6.1% from 5.4% in a matter of weeks.

The impact of BSP's raising of interest rates:

2) Banks will raise interest rates and will affect the financial systems. How?

Banks will prefer to remain their reserves [*] with the BSP rather than lending it out to consumers or businesses but if they will lend it out to you, at a higher interest rate.

Businesses and consumers will slow down borrowing.

Businesses will end up with bigger inventory as consumers buy less. Businesses will lower their prices to attract consumers to buy.

3) Consumers will be motivated to keep their money in the bank.

4) If you have a variable interest rate on your mortgage, the high-interest rate will eat up a bigger portion of your disposable income leaving you with little cash for spending.

However, if your interest rates are fixed, your mortgage payment remains unchanged with the rising interest rates.

5) Businesses will pull back their investment projects and borrowing because consumers are not buying. In effect, it’ll slow down economic activity.

As a result, fewer jobs for Filipinos or the available jobs offer lower salaries and wages resulting in lower income for households.

6) If you are an investor in the stock market, higher interest rates will affect the earnings of the companies as it’s expensive to raise capital so it’ll affect future growth prospects.

Bondholders [lenders or investors in debt] - An increase in interest will result in lower bond prices.

So, increasing interest rates will lead to lower spending and borrowing resulting in lower inflation.

IMPORTANT NOTE

It is also important to understand that raising interest rates is not like a pill to take if you have a common cold.

Policymakers prescribe anti-inflation remedies according to the cause of inflation.

In this case, the high inflationary period is caused by the Russian and Ukraine war and not due to fast economic growth so BSP will not implement contractionary policies to prevent inflation.

What our government is doing is to pick up partly the bill by offering free transport, rolling back petrol prices, and discussing the “suspension of the collection of excise taxes on diesel, gasoline, cooking gas and other oil fuel products.”

Also, BSP sets inflation expectations [If BSP is credible enough to influence it] by announcing their “targets of 2-4% in 2022 and could average near the upper band of the target in 2023” to influence the financial markets.

BSP has to tackle inflation because if it remains too long, employees will demand higher wages. This will result in higher operating expenses for businesses pushing prices further up. Also, it’ll result in more social issues [increase in poverty, discontent, crime].

However, raising the interest rates is not a magic wand where you wake up with lower prices the next day. In fact, it did not take effect immediately due to time and effect lag. Why?

We do not know the end of the Russian and Ukraine War [the major cause of inflation affecting the supply chain issues] so

- Consumers and businesses wait and see.

- Businesses will delay passing on the new interest rate.

- Do Filipino consumers check interest rates before making a decision?

Brace for the economic difficulties by adding more income sources and reining in on spending. The best to fight the lower purchasing power is to learn more and make informed decisions.

PS

[*]BSP is a bank of banks like BPI, BDO, Union Bank, Metrobank etc. These banks keep 12% of their reserve requirement [RR] from deposits at BSP.

The RR cannot be lent out to the public but can be lent out to each other to earn interest.

RR is the tool of BSP to control the money supply.

If BSP increases the supply of money faster than the growth of the economy, it’ll result in increasing inflation.